Tax season is here, and everyone working in the United States is required to file their taxes. To make the process easier for those in need, Dallas College has launched a free tax assistance program.

The Volunteer Income Tax Assistance (VITA) Program, supported by the IRS, is designed to help individuals and families with an annual income of less than $67,000.

The goal is to provide reliable tax filing services and prevent low-income earners from being charged high fees by private tax preparers.

The service is open to everyone, including students, faculty, staff and community members. People earning below $67,000, individuals with disabilities, and those facing language barriers are eligible for assistance. Students working on campus or under

Curricular Practical Training (CPT) or Optional Practical Training (OPT) may also qualify if they meet these requirements. Dallas College students, faculty and community members serve as volunteers for the program.

“Our volunteers are actually Dallas College students getting hands-on experience. We also have community members and students from other universitie that are a part.” said Wendy Garner, senior manager of community connections atDallas College.

All volunteers must pass the IRS certification tests to ensure that they are fully prepared to assist with tax filings. For those interested in becoming volunteers,opportunities are open to anyone regardless of their field of study or profession.

Interested individuals can explore Dallas College’s tax help website to learn more about becoming a certified voluneer. While this tax season is coming to an end, interested individuals can sign up in the fall to prepare for next year’s program.

Tax assistance is available at several Dallas College locations, including Mountain View Campus, Pleasant Grove Center, Red Bird Center, Garland Center and the Bill J. Priest Center in South Dallas.

Dallas College also partnered with nonprofits like Community Tax Centers and Sharing Life to expand its accessibility. Appointments can be scheduled through the Dallas College tax help website. Availability is limited as the April 15 tax deadlineapproaches. Walk-ins are welcome. “You can walk in and we will still see if we can help you. If we can’t assist you immediately, we will schedule an appointment before you leave,” said Garner.

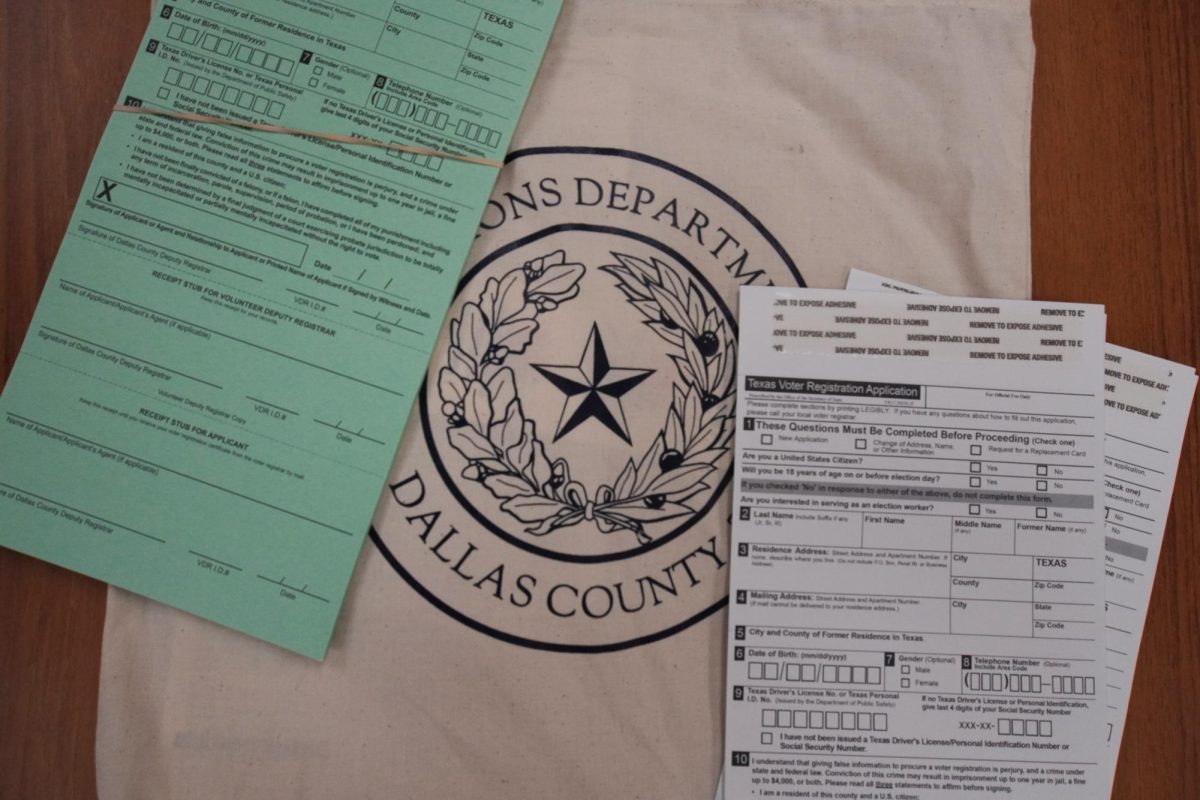

Individuals seeking tax assistance should bring the necessary documents, including Social Security Cards or ITIN letter for international students, a photo ID, tax forms, bank information and last year’s tax return, if available.

Additional information is available on the Free Tax Help page on the Dallas College website.

To make the service more accessible, Dallas College ensures language support for individuals with limited English proficiency will be available. The VITA program has volunteers who speak multiple languages.

“We also have a language line we can reach out to if needed to get an interpreter.” said Garner.

Beyond assisting the community, the program serves as a professional stepping stone for student volunteers.

“Once they get this experience, they get a certificate for their volunteer time and a referral letter, which can help them when applying to the IRS or other positions,” said Garner.

By offering this program, Dallas College continues to support its community bymaking tax filing easier, while providing students with valuable career-building experience.